Buying a house alone? Before you get started, it would be a good idea to have an understanding of where you can and can’t afford.

Buying with someone else (with two savings accounts) is hard enough, but is even more difficult if you’re alone. Where you choose to move to can make things easier.

Want to find out what the most affordable place for buying a property alone is? This research pulls together average mortgage and living costs, based on 30 of the most populated towns and cities in the UK. Let’s dig deeper.

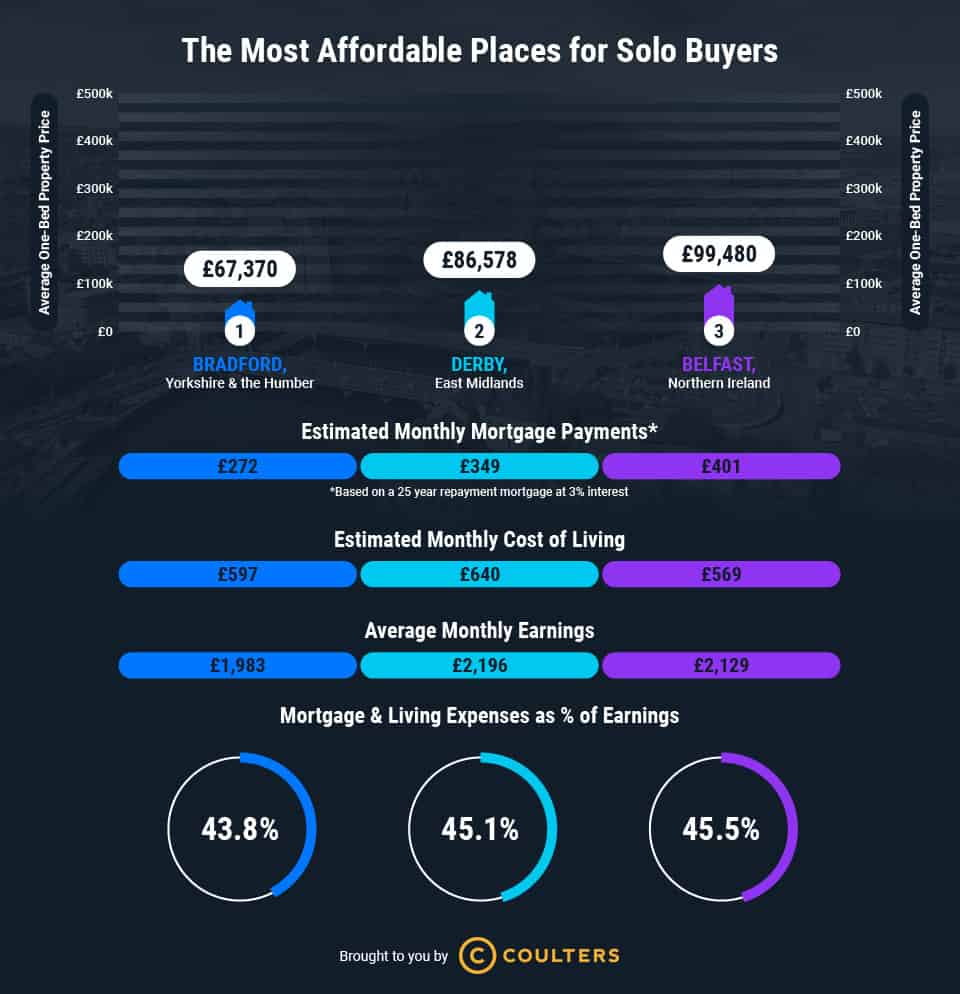

Most affordable places for buying a house alone in the UK

The 10 most affordable cities for solo buyers are:

- Bradford

- Derby

- Belfast

- Glasgow

- Aberdeen

- Stoke-on-Trent

- Leicester

- Leeds

- Liverpool

- Sheffield

| Rank | Town/City | Average One-Bed Property Price | Estimated Monthly Mortgage Payments* | Estimated Monthly Cost of Living | Average Monthly Earnings | Mortgage & Living Expenses as % of Earnings |

| 1 | Bradford | £67,370 | £272 | £597 | £1,983 | 43.8% |

| 2 | Derby | £86,578 | £349 | £640 | £2,196 | 45.1% |

| 3 | Belfast | £99,480 | £401 | £569 | £2,129 | 45.5% |

| 4 | Glasgow | £102,993 | £415 | £612 | £2,142 | 47.9% |

| 5 | Aberdeen | £80,830 | £326 | £674 | £2,069 | 48.3% |

| 6 | Stoke-on-Trent | £77,585 | £313 | £646 | £1,973 | 48.6% |

| 7 | Leicester | £103,762 | £418 | £641 | £2,164 | 49.0% |

| 8 | Leeds | £128,253 | £517 | £601 | £2,198 | 50.9% |

| 9 | Liverpool | £106,948 | £431 | £643 | £2,080 | 51.6% |

| 10 | Sheffield | £105,291 | £424 | £621 | £1,996 | 52.4% |

What does this mean?

Bradford comes out top of the class on this one. The average cost of a one-bed property is £67,370, much lower than towards the South of the UK. Here, mortgage repayments and living costs combined come to around 43.8% of a person’s average earnings. Unsurprisingly, this makes Bradford one of the easiest places to pay off a mortgage.

Not far behind is Derby, an English city known for its football and Silk Mill museum. Plus, here the average cost of living is £640 a month, while estimated mortgage payments are around £349, coming to around 45% of a person’s income. Home buyers can also snap-up a one-bed for less than £87,000.

Third on this list is Belfast, which is another good option for first time buyers looking to get on the property ladder, or those looking to climb up it. A one-bed property costs less than £100,000. This is combined with the fact that living costs and mortgage repayments come in less than half of an average person’s monthly income.

What makes somewhere affordable?

This research doesn’t just look at the cheapest places to buy a house, but also the cost of living in a particular area for a single person. After all, even after you buy a home, there are a number of ongoing costs associated with being a homeowner.

The estimated cost of living differs city to city, and takes into consideration a number of different factors, including food and transport.

Average monthly earnings have been calculated using ONS data for median annual salaries, dividing by 12 to get a monthly figure. (NINIS Gross Annual Pay was used for Belfast.)

When half, or less than half, of your monthly earnings is spent on living costs and mortgage payments, this is considered affordable. Meanwhile, the least affordable places are those where those expenses take up the majority of your earnings.

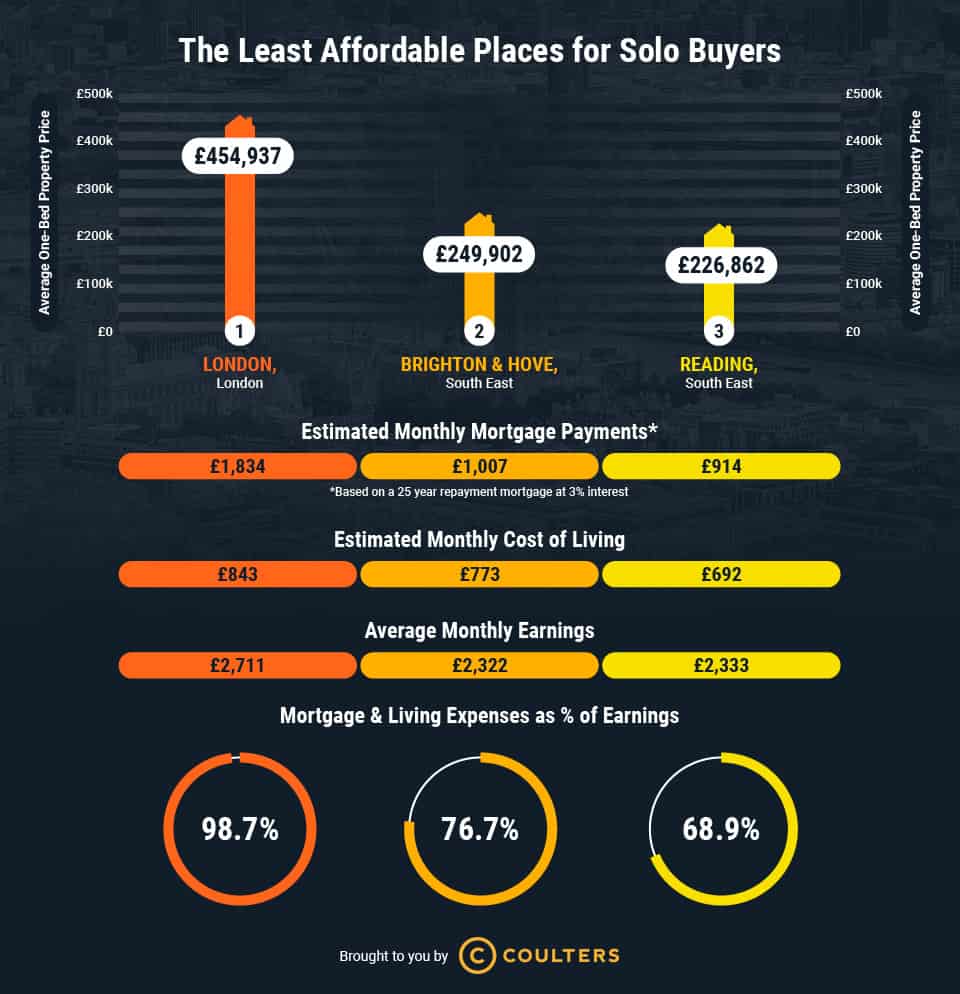

Where are the least affordable places for solo buyers?

For single people, it will likely be much more difficult to save for a house deposit and then keep up with the mortgage repayments. In these areas, that will see significant increases.

- London

- Brighton & Hove

- Reading

| Town/City | Average One-Bed Property Price | Estimated Monthly Mortgage Payments* | Estimated Monthly Cost of Living | Average Monthly Earnings | Mortgage & Living Expenses as % of Earnings |

| London | £454,937 | £1,834 | £843 | £2,711 | 98.7% |

| Brighton & Hove | £249,902 | £1,007 | £773 | £2,322 | 76.7% |

| Reading | £226,862 | £914 | £692 | £2,333 | 68.9% |

Clearly, the further south we head in the UK, the more expensive house prices are.

London

It may come as no surprise, but London sits head and shoulders above any other city on this list. Mortgage and living expenses combined come in at a whopping 98.7% of an average person’s earnings! Here, the average price of a one-bed is over £450,000. So, if you’re buying solo, you’ll likely find it’s significantly harder. That’s not to say it’s impossible, though.

Brighton & Hove

Nicknamed ‘London by the sea’ (most likely for more reasons than one), those who live in Brighton will spend around 77% of their earnings on living costs and paying off their mortgage. While it can boast stunning sea views and great nightlife, you’re looking at nearly £250,000 for a one-bed property. The estimated monthly cost of living doesn’t sit far behind London, at £773.

Reading

Third on our least affordable list is Reading, a large town in southern England. Here, mortgage payments and living expenses will come in at just under 70% of your monthly earnings. This makes it harder to pay off a mortgage, and afford to live, than in Derby, for example. A one-bed property isn’t much less than in Brighton, at £226,862. So, if this is an area you have your heart set on, it might take you a while to save up on your own!

Helpful tips to help you buy a home

Whether you want to live in an affordable area or not, purchasing a property is never easy. Here are some tips to make buying a house alone easier:

- Check your credit score beforehand

- Mortgage lenders will look at your credit history before accepting your mortgage application, so it helps to be in the know. If you can, pay off any credit card debts beforehand

- Factor in stamp duty (first time buyers pay nothing on the first £300,000)

- Consider interest rates when applying for a mortgage

- Save as a big a deposit as you can (it can help you find more attractive mortgage deals)

- Research an area thoroughly to see if you’ll enjoy living somewhere. A property report can help you do just that

- Consider living just outside of a popular town/city

Research from Coulters property.

Need help finding a mortgage adviser?

We can help connect you with the right people to make your dreams of owning a home a reality. Get a mortgage quote below.

Last Updated: January 3rd, 2024